Decentralized Trading on dYdX: The Ultimate Guide for Secure and Efficient Trading

Are you looking for a decentralized exchange that offers non-custodial trading with high liquidity and a wide range of assets? Look no further than dYdX. In this article, we will take an in-depth look at what dYdX is, how it works, and its key features, as well as a guide on how to use dYdX for decentralized trading. Additionally, we will compare dYdX with other decentralized exchanges and explore the benefits of trading on dYdX.

What is dYdX and how does it work for decentralized trading?

dYdX is a decentralized exchange built on Ethereum, allowing for peer-to-peer trading of cryptocurrency assets. It is a decentralized finance (DeFi) platform that operates on a non-custodial model, meaning that users have full control over their funds and private keys. dYdX uses smart contracts to facilitate trustless trading, making it a more secure and efficient way of trading compared to traditional centralized exchanges.

Key Features of dYdX Decentralized Exchange

Non-Custodial Trading

As previously mentioned, dYdX operates on a non-custodial model, allowing to have complete control over their funds and private keys. This means that users are not required to deposit their funds into a centralized exchange or third-party wallet, which reduces the risk of losing funds due to hacking or other security issues.

High Liquidity

dYdX offers high liquidity, meaning that users can trade their assets without the need for market makers or liquidity providers. dYdX uses a hybrid order book model, which combines centralized order books with on-chain settlement, providing fast and efficient trading with minimal slippage.

Wide Range of Assets Supported

dYdX supports a wide range of assets, including major cryptocurrencies such as Bitcoin, Ethereum, and USDC, as well as smaller altcoins such as Chainlink, Compound, and Aave. This allows users to trade a diverse range of assets on one platform, without the need for multiple exchanges.

How to Use dYdX for Decentralized Trading

Creating an Account

To start trading on dYdX, users need to connect their Ethereum wallet, such as MetaMask, to the dYdX platform. Once connected, users can create an account on the dYdX platform and set up their profile.

Depositing Funds

To deposit funds, users need to transfer their assets to the dYdX smart contract, which can be done directly from their Ethereum wallet. dYdX supports a wide range of assets, and users can deposit as little or as much as they want.

Trading Assets

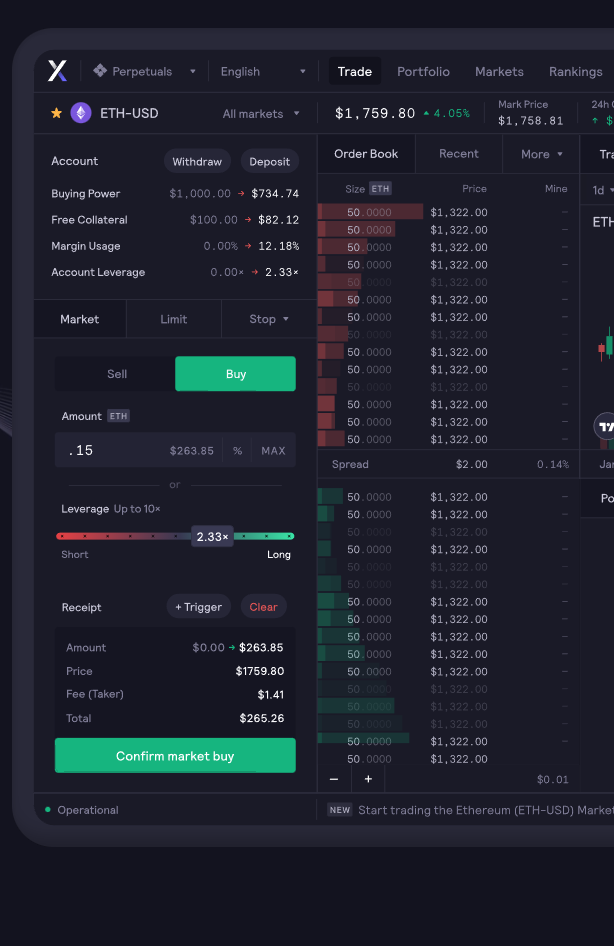

Once funds have been deposited, users can start trading their assets. dYdX offers various order types, including limit orders, market orders, and stop orders, allowing users to execute trades at their desired price points.

Benefits of Trading on dYdX

Decentralization and Security

One of the main benefits of trading on dYdX is its non-custodial model, which provides users with full control over their funds and private keys. This means that users do not need to trust a third party with their assets, reducing the risk of funds being lost due to hacking or other security issues. Additionally, dYdX uses smart contracts to facilitate trustless trading, making it a more secure and efficient way of trading compared to traditional centralized exchanges.

Efficient and Cost-Effective Trading

dYdX offers high liquidity, allowing users to trade their assets quickly and efficiently with minimal slippage. Additionally, dYdX charges low trading fees, making it a cost-effective way of trading compared to traditional centralized exchanges.

dYdX vs Other Decentralized Exchanges

Comparison with Uniswap

Uniswap, which uses an automated market maker (AMM) model to determine asset prices, is a popular decentralized exchange with high liquidity. However, the lack of an order book in Uniswap may result in higher slippage for larger trades. In contrast, dYdX uses a hybrid order book model that combines centralized order books with on-chain settlement to provide faster and more efficient trading with minimal slippage. Furthermore, dYdX charges lower trading fees than Uniswap, with a flat fee of 0.05% per trade compared to Uniswap's 0.3% fee. For traders who prioritize low trading fees and minimal slippage, dYdX may be a more attractive option than Uniswap.

Comparison with SushiSwap

SushiSwap is another decentralized exchange that operates on an AMM model and offers a governance token called SUSHI. In contrast, dYdX does not have a governance token, and its trading fees are used to support the development and maintenance of the platform.

While SushiSwap may have a more decentralized governance model, it charges higher trading fees compared to dYdX, with a fee of 0.3% per trade. Additionally, dYdX's hybrid order book model provides faster and more efficient trading with minimal slippage, making it a more attractive option for traders.

Conclusion

In conclusion, dYdX is a decentralized exchange that offers non-custodial trading, high liquidity, and a wide range of assets supported. Its smart contract-based trading provides a more secure and efficient way of trading compared to traditional centralized exchanges. Additionally, dYdX charges low trading fees, making it a cost-effective way of trading for users.

When compared to other decentralized exchanges such as Uniswap and SushiSwap, dYdX offers faster and more efficient trading with minimal slippage, as well as lower trading fees. Overall, dYdX is a great option for users looking for a secure and cost-effective way of trading cryptocurrencies in a decentralized manner.